Our services

FCA and PRA Compliance Checks

We supply an FCA check that is detailed, fast, cost effective and that meets the requirements of the FCA and PRA on your behalf.

The Financial Services Authority (FSA) , now divided into the Financial Conduct Authority (FCA) and the Prudential Regulation Authority, requires detailed FCA screening that includes verification and registration of regulated and non-regulated employees covering; honesty, integrity, reputation, competence, and capability.

In the FCA handbook, the Financial Conduct Authority indicates that “background checks should be proportionate and risk-based and should be repeated or on-going where appropriate, for example for staff in high risk roles”. Checkback International ensures our FCA checks offer you a screening service that complies with the FCA’s requirements.

Our services have three levels that will help companies at different points in the FCA regime;

- FCA level 1 – Basic, which covers most roles within an FCA regulated business

- FCA level 2 – Standard, and for senior FCA-controlled functions only

- PCI Compliance (Payment Card Industry)

FCA level 1 screening

For FCA regulated firms, the FCA suggests that there are security measures taken that are proportionate to the risk involved.

From an employment point of view, this means that firms need to ensure that their staff are approved persons suitable for employment and can comply with the requirements of honesty, integrity, financial soundness and competence and capability.

For many employees working in a regulated firm, the risk of harm is relatively low – however, we have developed a comprehensive but cost-effective, fast and efficient service that supports HR and compliance departments in financial services and markets.

Our FCA level 1 check provides the employer with confidence that the person they are making a job offer to will be suitable from the compliance point of view.

FCA level 2 screening

For higher-level employees, the FCA has introduced the SMCR regime.

The scheme is designed to ensure that those directing the work of the company are of the highest personal integrity and that they are held responsible for the failings of the firm.

Our level 2 check is a response to the needs of SMCR both for controlled positions and for the certificated roles.

Our pre-employment service includes enhanced reference checks, a much more detailed DBS check, a fit and proper test, in-depth qualification checks and a Media Scanning service which supports the personal integrity criteria.

A more detailed check than the FCA Level 1 check, FCA Level 2 is targeted at more senior roles and employees with enhanced responsibilities.

PCI compliance screening

The PCI DSS is a mandatory security standard that is designed to protect customers during card processing.

This covers all aspects of the process from telephone recordings to software to data protection and of course the staff that are involved.

Our PCI compliance screening service enables your organisation to satisfy the requirement of the Payment Card Industry Data Security Standard (PCI DSS) for your employees, contractors or temporary staff.

Organisations involved in card processing must ensure that they carry out background checks on all staff prior to them starting work and this applies to permanent and temporary employees as well as contractors and consultants.

The PCI standard mandates that screening must include employment history, criminal record, credit history, and reference checks.

At Checkback we are able to help you comply with the standard by using our PCI service which offers

An FCA Check from the Checkback International includes

- 5 years history reference checks

- FCA register (controlled position) regulatory reference

- Gap Analysis – gaps over 31 days covered with a gap reference

- Highest Qualification check

- Professional Qualifications

- Professional Memberships

- 6 -year UK /IRE Financial Check

- Bankruptcy/insolvency

- CCJs

- Credit Score

- Electoral Roll

- Anti-Fraud Checks

- UK BOE Sanctions Search & Money Laundering Check

- FCA register search

- OFAC – Special Designated Nationals lists

- Directorship search

- Property Ownership

- Identity Checks

- Verification of the MRZ code on right to work & Proof of ID documents

- Proof of address checked against details & credit check

- Proof of ID

- Right to Work

- Criminal Record Checks UK & Europe

- European criminal Record Check – 25 of 28 EU states currently co-operating

- Basic Disclosure & Barring Service (DBS Check)

- Previous 3 years employment verification

- Criminal record check (Basic Disclosure)

- Credit, insolvency and bankruptcy search

- Proof of Address

This is an robust and comprehensive list of tests to make ensure your employees are, fit, proper and of the highest standard.

Some elements of the FCA checks are also part of the standard compliant employee onboarding process.

At FCA level 2 screening, we include a standard DBS check, 10 years of reference history, top 3 educational attainment checks and a full media search.

Our level 2 check is a market-leading service and one that we designed specifically with the SMCR regime in mind.

For added peace of mind, we can include tailored elements such as a Client Specific Fitness & Probity Declarations Statements or Europe-wide criminal record checks.

Contact us to discuss your FCA screening requirements with one of our Screening Team experts

Choose Checkback International for FCA Level 1 and 2 Screening and PCI Compliance Screening.

- Checkback International FCA screening is a more cost-effective solution compared to an FCA check carried out by in-house teams

- Consistent and auditable process

- Compliant with the FCA and PRA guidelines

- Fast turnaround process. The provisional FCA pre screen process is carried out within five days to ensure a fast hiring decision can be made. This is followed by a comprehensive written report within 10 days

- Online applications via our online portal or, alternatively, we can provide you with paper application forms

- Fast delivery of a professional candidate screening report to support hiring process and complete the employee HR file

A genuinely cross-border service

By their very nature, good executives tend to be internationalists, working across sector and across borders.

This means that standard executive vetting companies can’t cope with the complexity needed to manage international checks.

We have built up our systems with the purpose of being able to check any executives history, whatever country or company they have worked for.

We have offices in the UK, Ireland, Poland and Spain and utilise our extensive network of partners to produce executive vetting reports that are accurate and tell the real story.

Typical checks considered by clients using this screening type are listed below.

Turn around times: 3 to 10 days (for Standard Reports)

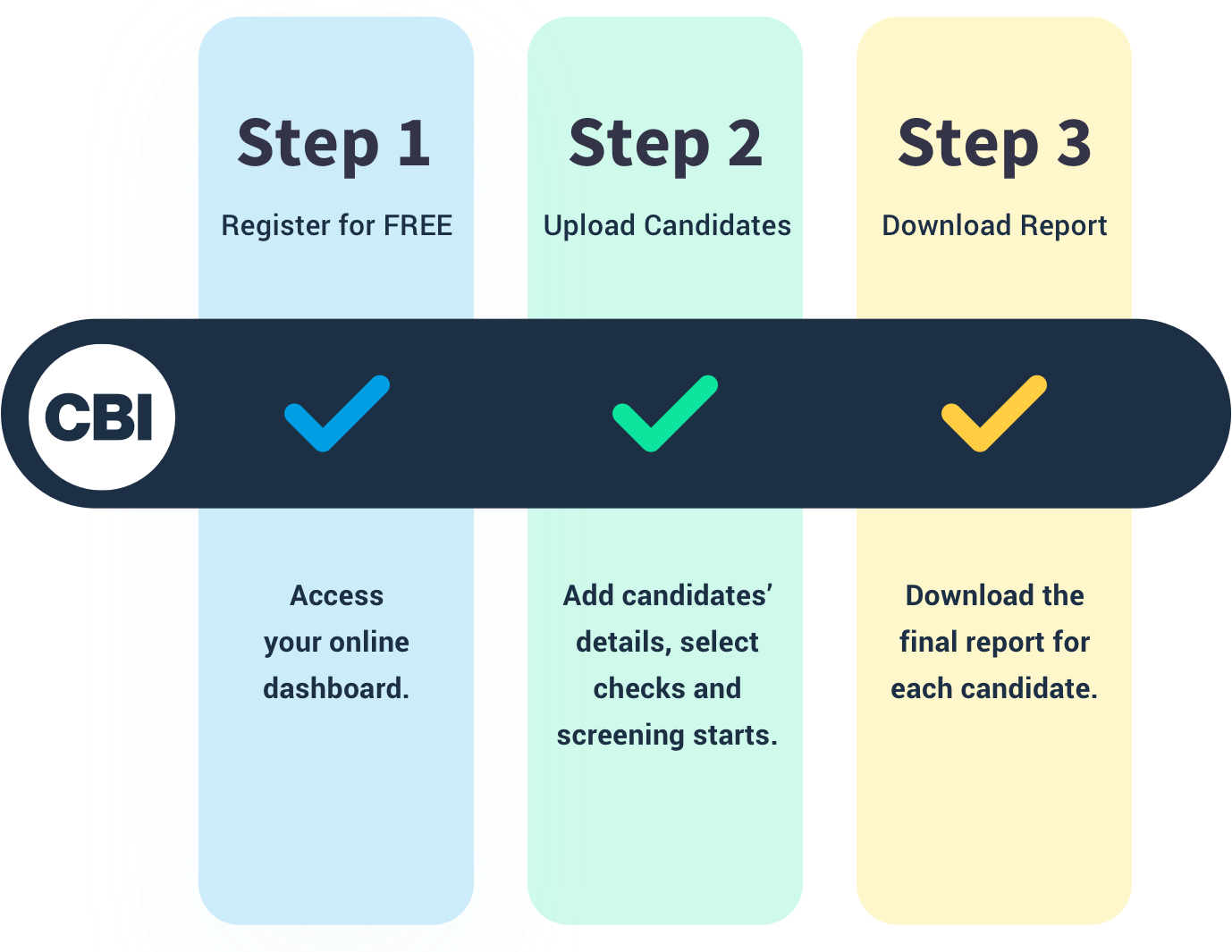

Screening and vetting services simplified

It’s a simple 1,2,3 step process

Checkback International delivers a fully managed service that has been developed to meet clients’ needs – whatever they may be. We tailor our service around your requirements, so you get the seamless, client-focused process that best works for your organisation. Choose from one of our most requested options:

- Self-manage the checking process through your secure dashboard

- Use our fully managed Checkback Screening Expert Service, with no additional charge attached

- Build the service that suits you, with a blend of the two options above

Your checks, your way

We’re committed to delivering the background checks that our clients need, with screening excellence as standard and a fully managed service at no extra cost. With complete transparency on the checking process from your dashboard, you can even review the conversations taking place between your Screening Team and your candidates and referees.

Start screening in just 3 clicks and track progress in real time, via our proprietary vetting software.